Table Of Content

- How To Get a Lower Mortgage Refinance Rate

- What’s the difference between APR and interest rate?

- Mortgage Interest Rates Today, April 26, 2024 Are Homebuyers Adjusting to Higher Rates?

- Featured mortgage articles

- How To Shop For the Best Mortgage Rate

- Why are mortgage rates so high?

- Mortgage Rates Today: April 15, 2024—15-Year and 30-Year Mortgage Rates Move Up

- Average long-term US mortgage rate climbs for the fourth straight week

We love helping people understand how rates work and what yours could be. "We got great, attentive service, and importantly, a very competitive rate that we were happy with." "was easy to upload documentation, i got a great rate, and am extremely happy with the service." Buying a house in California is a pricey proposition, but first-time homebuyers might qualify for grants or other forms of help.

How To Get a Lower Mortgage Refinance Rate

Compare your credit score, debt-to-income ratio and loan amount to the ones we used by selecting the View Legal Disclosures link under where rates are displayed. For example, FHA loans can require 3.5% down with a minimum credit score of 580 or at least 10% down with a credit score between 500 and 579. However, upfront and annual mortgage insurance premiums can apply for the life of the loan. A mortgage rate shows you the amount of money you’ll have to pay as a fee for borrowing funds to purchase a home, and is typically expressed as a percentage of the total amount you’ve borrowed. You can check rates online or call lenders to get their current average rates. You’ll also want to compare lender fees, as some lenders charge more than others to process your loan.

What’s the difference between APR and interest rate?

Shorter loan terms (10-year mortgages or 15-year mortgages) typically come with lower interest rates compared to longer terms. Shortening the loan term can help you save a tremendous amount of money. Paying attention to your mortgage rate could help you shave thousands of dollars -- or even tens of thousands -- off the total cost of your loan. This is a situation where your efforts could have a big payoff. Here's what you need to know about getting the best current mortgage rate.

Mortgage Interest Rates Today, April 26, 2024 Are Homebuyers Adjusting to Higher Rates?

Let us estimate your rate and help you reach your financial goals. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. If you already have a mortgage and are considering a refinance, get customized rates for your unique circumstances. The APRs on this page are for purchasing mortgages, which are typically similar to refinance rates.

Featured mortgage articles

Experts believe that once the Fed cuts rates in 2024, refinance volume will improve as borrowers who took on high mortgage rates will jump at the chance to lower their monthly costs. If you’re considering refinancing to lower your mortgage rate, then you’ll want to compare interest rates and fees by lender. Many lenders don’t disclose fees or even rates online so you might have to contact them and ask for a list of their fees and what their rates are.

How To Shop For the Best Mortgage Rate

This same time last week, the 15-year fixed-rate mortgage APR was 6.93%. However, the total amount of interest you pay on a 15‑year fixed-rate loan will be significantly lower than what you’d pay with a 30‑year fixed-rate mortgage. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. One mortgage point is equal to about 1% of your total loan amount, so on a $250,000 loan, one point would cost you about $2,500. A mortgage rate lock is your lender's guarantee that you will pay an agreed-upon interest rate if you close on the loan by a specified deadline as long as there are no changes to your application.

First, you don’t need to make a down payment in most situations. Second, borrowers pay a one-time funding fee but don’t pay an annual fee as the FHA and USDA loan programs require. Buyers in eligible rural areas with a moderate income or lower may also consider USDA loans.

There are also no credit score minimums for USDA or VA refinances; however, lenders might apply their own standards to these refinances. The average APR on the 30-year fixed-rate jumbo mortgage refinance is 7.72%. This week, average 15-year mortgage rates were 6.44%, a five-basis-point increase from the previous week, according to Freddie Mac data.

Mortgage rates drop below 7 percent as home-buying pressures ease - The Washington Post

Mortgage rates drop below 7 percent as home-buying pressures ease.

Posted: Thu, 14 Dec 2023 08:00:00 GMT [source]

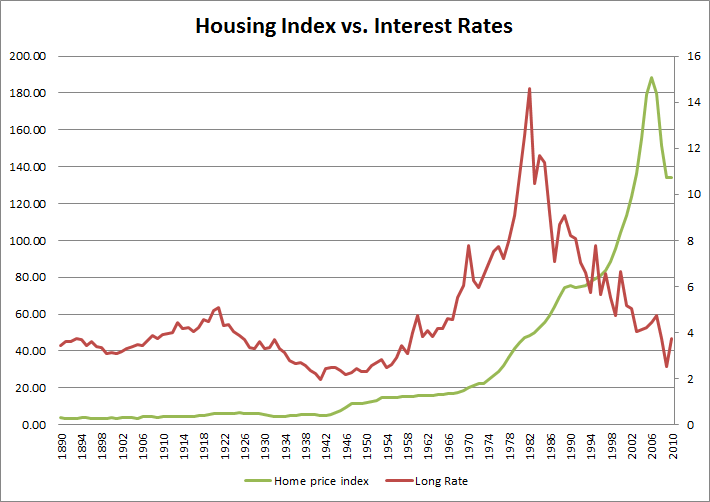

The federal funds rate is the overnight borrowing rate for commercial banks and credit unions and indirectly influences mortgage rates. Something deeply unusual has happened in the American housing market over the last two years, as mortgage rates have risen to around 7 percent. Mortgage refinancing is when you replace one home loan with another in order to access a lower interest rate, adjust the loan term or consolidate debt. Refinancing requires homeowners to complete a new loan application and may involve an appraisal and inspection of the home. Lenders also rely heavily on an applicant’s credit score and debt-to-income ratio when deciding whether to extend a new loan.

The interest rate is the amount your lender charges you for using their money. ARM loan rates are based on an index and margin and may adjust as outlined in your agreement. So it’s a good idea to check assumptions when you’re comparing rates. To see ours, select the View Legal Disclosures link under where rates are displayed. Your rate will be different depending on your credit score and other details.

Because the adjustment period is unpredictable, ARM loans are seen as a high-risk loan option while 30-year mortgages are viewed as low-risk. Bankrate is an independent, advertising-supported publisher and comparison service. We arecompensatedin exchange for placement of sponsored products and services, or when you click on certain links posted on our site. However, this compensation in no way affects Bankrate’s news coverage, recommendations or advice as we adhere to stricteditorial guidelines. Homeowners still have time to lower their monthly mortgage payments by refinancing, as mortgage rates are still relatively low.

When she’s not working on finance-related content, Caroline enjoys baseball, traveling and going to concerts. The average mortgage rate for a 30-year fixed is 7.12%, nearly double its 3.22% level in early 2022. Rates that high are not, by themselves, historically remarkable. The trouble is that the average American household with a mortgage is sitting on a fixed rate that’s a whopping three points lower.

Individual circumstances like credit score, down payment and income, as well as varying levels of risk and operational expenses for lenders, can also affect mortgage rates. The best mortgage rate for you will depend on your financial situation. The standard 30-year fixed rate mortgage is benchmarked off the 10-year U.S. The spread reflects the "cost" of the mortgage to an investor based on the risks that the borrower could prepay their loan down the road or default on the loan in the future. These costs rise and fall with general economic conditions, including the prevailing interest rate environment causing rates to rise and fall according to changes in the risk of these loans to investors.

Chris Jennings is a writer and editor with more than seven years of experience in the personal finance and mortgage space. He enjoys simplifying complex mortgage topics for first-time homebuyers and homeowners alike. His work has been featured in a number of outlets, including Yahoo Finance, MSN, Fox Business, and GOBankingRates.

There are many ways to search for the best mortgage lenders, including through your own bank, a mortgage broker or shopping online. To help you with your search, here are Forbes Advisor’s picks of the best mortgage lenders across the country. Finally, when you’re comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

No comments:

Post a Comment