Table Of Content

The rate you’re offered on a mortgage will also depend on the lender you work with, its business costs and your financial profile. NerdWallet’s daily mortgage rates are an average of the published annual percentage rate with the lowest points from a sampling of major national lenders. The APR is based on the interest rate and includes mortgage origination fees and discount points to indicate all of the costs of getting the loan. If you want the predictability that comes with a fixed rate but are looking to spend less on interest over the life of your loan, a 15-year fixed-rate mortgage might be a good fit for you. Because these terms are shorter and have lower rates than 30-year fixed-rate mortgages, you could potentially save tens of thousands of dollars in interest.

Mortgage refinance news

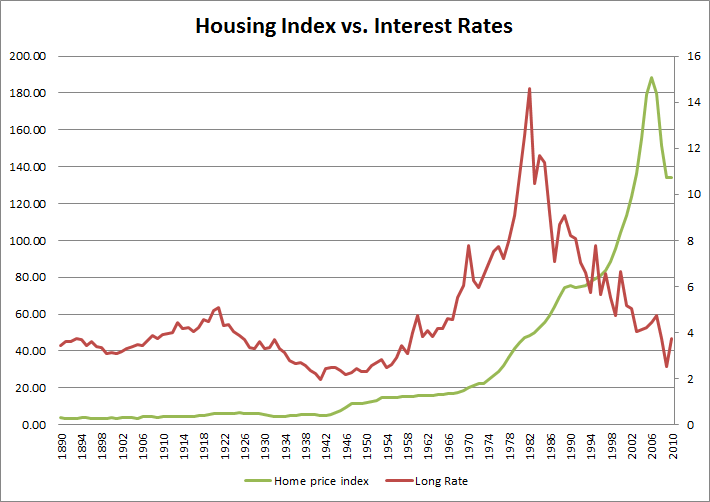

Kimberly is a career writer and editor with more than 30 years' experience. She's a bankruptcy survivor, small business owner, and homeschool parent. In addition to writing for The Motley Fool, she offers content strategy to financial technology startups, owns and manages a 350-writer content agency, and offers pro-bono financial counseling. These are the eight factors that can help you get the best current mortgage rate. Greg McBride, CFA, is the Chief Financial Analyst for Bankrate.com, leading a team responsible for researching financial products, providing analysis, and advice on personal finance to a vast consumer audience. The highest interest rates in recent history were seen in the early 1980s when the Fed hiked the federal funds rate to over 19%.

How to shop for a mortgage without hurting your credit score

The lowest-risk rate locks are fee free and have a float-down feature. Searching for an account where you can put some money aside? Here’s a look at some of the best savings rates you can find today. Rates on savings accounts are the same compared to one week ago. In a period of rising or volatile interest rates—like the present one—it may be wise to lock in a rate that seems affordable for you.

Another week of elevated mortgage rates, 30-year at 7.3%

With no appraisal needed for a loan, there is no independent third party providing an estimate for the value of the home. Ultimately, if homebuyers are looking to get the best price on a home, they should exercise caution if paying for a home with cash, or instead take advantage of historically low mortgage rates. If you want to uncover more about the best mortgage lenders for low rates and fees, our experts have created a shortlist of the top mortgage companies. Some of our experts have even used these lenders themselves to cut their costs. For example, you might find that a lender offers different rates for conventional loans and government-backed loans.

High Mortgage Rates Have Prevented the Sale of More Than a Million Homes in the U.S. - Investopedia

High Mortgage Rates Have Prevented the Sale of More Than a Million Homes in the U.S..

Posted: Sun, 24 Mar 2024 07:00:00 GMT [source]

The key to choosing a mortgage lender is to comparison shop. That means getting quotes from at least three to five lenders. It may sound like a hassle but it could save you tens of thousands of dollars. Mortgage points represent a percentage of an underlying loan amount—one point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when they’re initially offered the mortgage.

Second home mortgage rates for April 2024 - CNN Underscored

Second home mortgage rates for April 2024.

Posted: Thu, 15 Feb 2024 08:00:00 GMT [source]

Average long-term US mortgage rate climbs for the fourth straight week

Lauren Graves is an educator-turned-editor specializing in personal finance content. She seeks to make complicated topics easier to understand and less intimidating to the average reader with accurate, reliable information and transparent writing. Her expertise includes banking product reviews and general topics universal to personal finance such as saving and budgeting. Her work has been featured in Money Under 30, Investor Junkie, Doughroller, Saving for College and APY GUY. Curinos determines the average rates for savings accounts by focusing on those intended for personal use.

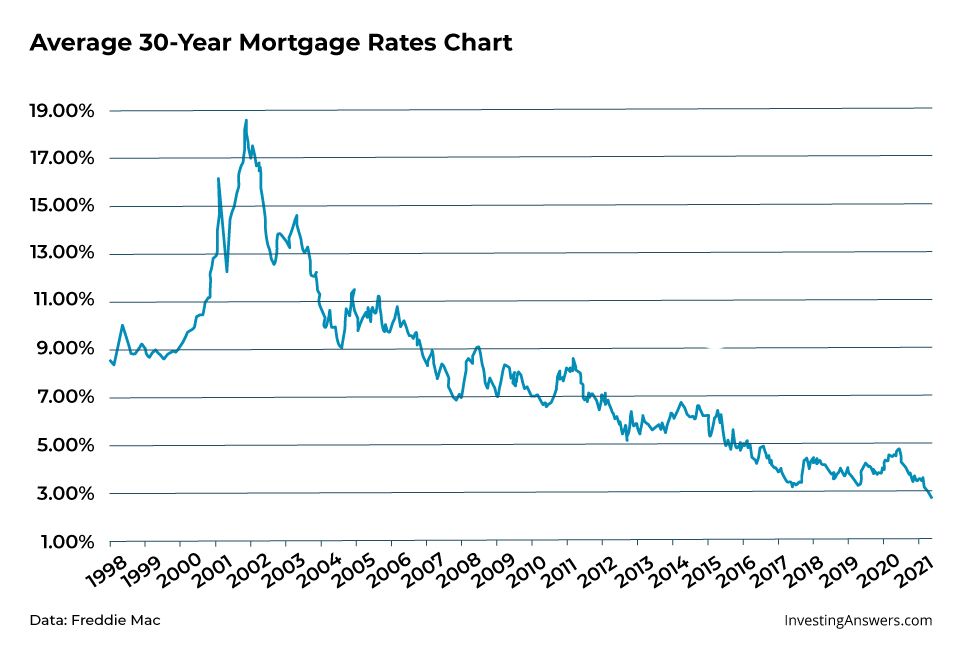

Federal Reserve raises its interest rate target for overnight lending between banks, and interest rates throughout the financial sector typically follow suit. From March 2022 to July 2023, the Fed raised its policy rate 11 times, leading to a surge in mortgage rates. A change in demand for 10-year Treasury bonds and mortgage-backed securities also contributed to 2023’s higher rates. The APR is the total cost of your loan, which is the best number to look at when you’re comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders (with higher rates and lower fees), so you’ll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

“Hopefully, we’re near the end of this part of the rate cycle, and interest rates will decline at some point in the next year or two,” says Cohn.

Estás ingresando al nuevo sitio web de U.S. Bank en español.

"This was my first real mortgage … the interest rate was way better than anyone else could offer and the process … was so fluid." The final real estate brokerage involved in a major lawsuit over agent commissions has agreed to a settlement in the landmark case. HomeServices of America will pay $250 million to resolve a series of lawsuits that challenged how real estate... This will give you an idea of the type of house you can afford. A good place to start is by using a mortgage calculator to get a rough estimate.

You can bump up your credit score by paying off credit card debt and reducing how much you use your cards. If you do use credit cards for rewards and points, try to pay them off immediately—don’t wait for your monthly statement to come in because your score can change daily. As inflation comes down, mortgage rates will recede as well. Average 30-year mortgage rates increased to 7.17% this week, according to Freddie Mac.

The median home sale price in the state was up 6.4 percent year-over-year as of December 2023, according to the California Association of Realtors. Those gains, plus today’s higher mortgage rate environment, continue to make housing affordability a challenge. You need to apply for mortgage preapproval to find out how much you could qualify for. Lenders use the preapproval process to review your overall financial picture — including your assets, credit history, debt and income — and calculate how much they’d be willing to lend you for a mortgage.

The first thing borrowers need to think about is what type of product they want. One is a fixed-rate amortizing loan, such as the common 30-year amortizing mortgage. The other is an adjustable rate mortgage (ARM) where the rate can fluctuate over time. Once you've made that choice, then you can look at any number of websites that post mortgage rates to see which is the best fit for your needs.

Today’s average rate on a 30-year mortgage (fixed-rate) rose to 7.65% from 7.57% yesterday. As of Saturday, April 27, 2024, current interest rates in California are 7.47% for a 30-year fixed mortgage and 7.00% for a 15-year fixed mortgage. After selecting your top options, connect with lenders online or on the phone. Then choose a lender, finalize your details, and lock in your rate.

This home loan has relatively low monthly payments that stay the same over the 30-year period, compared to higher payments on shorter term loans like a 15-year fixed-rate mortgage. If you prefer predictable, steady monthly payments, a 30-year fixed-rate mortgage might be a great option. Use our free mortgage calculator to see how today's mortgage rates would impact your monthly payments. By plugging in different rates and term lengths, you'll also understand how much you'll pay over the entire length of your mortgage.

However, you'll have a higher monthly payment than you would with a longer term. The annual percentage rate (APR) represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased or decreased after the closing date for adjustable-rate mortgages (ARM) loans. Mortgages come in various terms (the number of years it takes to pay off the loan) and types (such as conventional, FHA, VA, jumbo). Fixed-rate mortgages keep the same interest rate throughout the term; with adjustable-rate mortgages, interest rate changes over time can make monthly payments go up or down. A 30-year fixed-rate mortgage is by far the most popular home loan type, and for good reason.

Following the COVID-19 pandemic, the Fed implemented an expansionary monetary policy to help the economy, resulting in great rates for homeowners. If a homeowner has not taken advantage of the great rates in the last two years, they should refinance as soon as possible to try to lock in a lower rate. In fact, due to the increase in inflation, the Fed has signaled that it will increase short-term rates and reduce the QE programs, resulting in higher rates for refinancing. You might qualify for the best current mortgage rate if you can make a 20% (or larger) down payment. That's because making a bigger down payment reduces your loan-to-value ratio, which lowers the risk for the lender, which in turn could qualify you for a lower rate.